What You Need to Learn About Selecting the Best Insurance Plan

What You Need to Learn About Selecting the Best Insurance Plan

Blog Article

The Function of Insurance in Financial Preparation: Securing Your Possessions

Importance of Insurance Coverage in Financial Preparation

Insurance coverage plays a crucial function in an individual's financial planning method, acting as a guard versus unforeseen occasions that can threaten monetary security. By mitigating threats related to health problems, residential or commercial property damage, or obligation claims, insurance coverage provides a financial safeguard that permits individuals to maintain their economic health also in unfavorable conditions.

The relevance of insurance coverage extends beyond mere monetary defense; it likewise fosters long-term economic technique. Normal premium settlements encourage individuals to spending plan efficiently, making certain that they allot funds for possible dangers. Certain insurance coverage products can offer as financial investment automobiles, adding to wide range accumulation over time.

Additionally, insurance coverage can boost a person's capacity to take computed risks in other areas of financial planning, such as entrepreneurship or financial investment in realty. Recognizing that there is a safeguard in position permits higher self-confidence in seeking chances that might otherwise seem discouraging.

Inevitably, the assimilation of insurance into financial planning not only secures assets yet also facilitates a more resilient financial technique. As people browse life's unpredictabilities, insurance coverage stands as a foundational aspect, allowing them to construct and maintain wide range over the long-term.

Types of Insurance Policy to Think About

When evaluating a detailed economic strategy, it is important to consider various kinds of insurance coverage that can deal with different elements of threat monitoring. Each type offers an unique function and can protect your assets from unforeseen occasions.

Medical insurance is vital, safeguarding and covering clinical expenses against high healthcare expenses - insurance. Property owners insurance policy secures your property and possessions from damage or theft, while additionally giving obligation protection in case somebody is hurt on your properties. Car insurance is critical for vehicle owners, supplying security versus damages, burglary, and liability for injuries suffered in mishaps

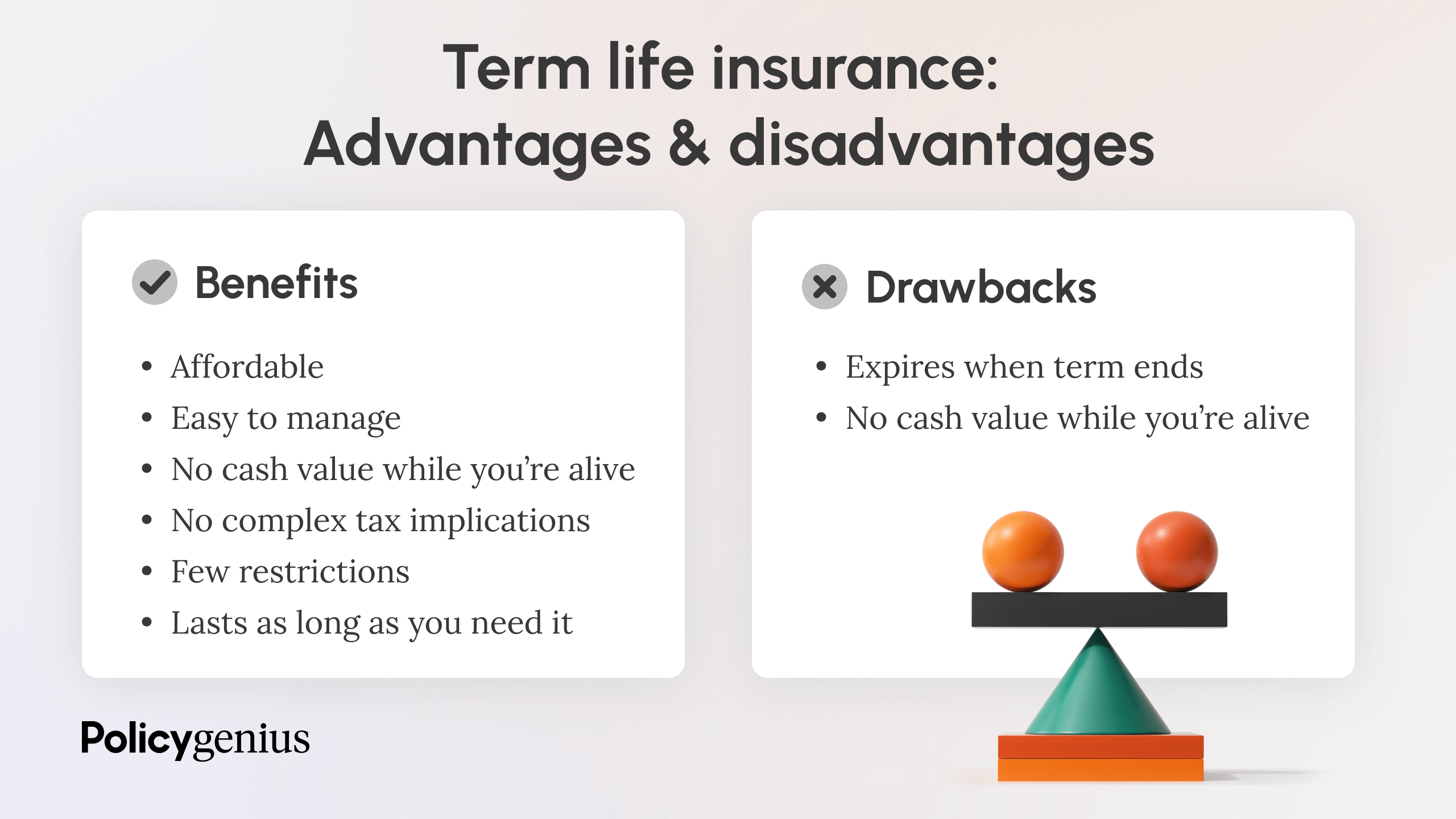

Life insurance coverage provides economic safety and security for dependents in case of an untimely death, guaranteeing their demands are satisfied. Disability insurance policy is similarly vital, as it changes lost revenue during periods of illness or injury that prevent you from working. Additionally, umbrella insurance offers extra responsibility insurance coverage past common plans, providing an added layer of defense versus considerable cases.

Examining Your Insurance Policy Requirements

Identifying the proper degree of insurance coverage is a crucial step in safeguarding your monetary future. To analyze your insurance needs successfully, you must begin by evaluating your existing properties, obligations, and overall economic goals. This entails thinking about variables such as your earnings, savings, financial investments, and any financial obligations you may have.

Next, recognize possible dangers that could affect your economic stability. Assess the possibility of events such as ailment, accidents, or residential or commercial property damage. This threat assessment will certainly help you establish the types and amounts of insurance policy required, consisting of health and wellness, life, impairment, homeowner, and car's insurance coverage.

Additionally, consider your dependents and their economic requirements in case of your unfortunate passing away - insurance. Life insurance may be important for ensuring that loved ones can maintain their way of life and satisfy monetary responsibilities

Integrating Insurance With Investments

Incorporating insurance policy with financial investments is a strategic method that boosts monetary security and development capacity. Insurance coverage products, such as entire life or global life policies, often have an investment element that allows insurance holders to accumulate cash worth over time.

Furthermore, incorporating life insurance with investment approaches can offer liquidity for recipients, Learn More Here ensuring that funds are readily available to cover prompt expenditures or to invest better. This synergy permits a much more extensive risk monitoring strategy, as insurance coverage can secure against unpredicted circumstances, while financial investments function in the direction of achieving economic goals.

Furthermore, leveraging tax advantages connected with particular insurance policy items can improve general returns. The cash worth growth in permanent life insurance policies might expand tax-deferred, providing a distinct advantage contrasted to traditional investment vehicles. Successfully integrating insurance with financial investments not just safeguards possessions but additionally optimizes growth possibilities, resulting in a robust monetary strategy tailored to specific requirements and goals.

Usual Insurance Coverage Myths Disproved

Misconceptions concerning insurance can dramatically hinder reliable economic planning. One common misconception is that insurance is an unneeded expenditure. In truth, it offers as an essential safeguard, shielding assets and making sure economic security in times of unexpected occasions. Several individuals likewise think that all insurance policy policies coincide; however, protection can differ extensively based upon the copyright and details terms. This variance highlights the significance of understanding policy information prior to making a choice.

An additional typical myth is that younger individuals do not need life insurance coverage. Additionally, some think that health and wellness insurance coverage covers all clinical expenses, which is not the instance.

Last but not least, the belief that insurance is just advantageous during emergency situations neglects its role in aggressive economic planning. By including insurance into your approach, you can protect your properties and enhance your total monetary resilience. Dispel these sites misconceptions to make enlightened decisions and maximize your monetary planning efforts.

Final Thought

In conclusion, insurance coverage offers as a fundamental component of efficient financial planning, providing crucial security versus unanticipated dangers and contributing to asset protection. By recognizing various types of insurance coverage and evaluating specific needs, one can attain a balanced financial technique.

In the realm of monetary planning, insurance policy offers as a keystone for safeguarding your assets and ensuring lasting stability.The importance of insurance extends beyond plain economic defense; it likewise promotes long-lasting economic self-control.Misconceptions regarding insurance coverage can considerably prevent effective monetary planning.Lastly, the belief Learn More that insurance policy is only valuable during emergency situations overlooks its duty in proactive economic planning.In conclusion, insurance policy serves as a basic component of reliable economic planning, offering important protection versus unanticipated dangers and contributing to property safety and security.

Report this page